Are mortgage processing times too slow? New tenancy laws and House prices outpace apartments.

Too long; didn't read? Here're this week's TLDRs...

Home values fell in 2024, stabilisation expected in 2025

Read the article

Housing market sees declining prices and low new listings

Read the article

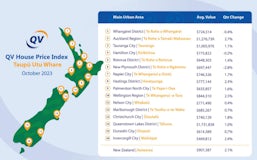

Auckland and Wellington property values continue to decline

Read the article

Barfoot & Thompson's December sales strong; prices slightly down

Read the article

House prices outpace apartments due to land value appreciation

Read the article

Construction sector poised for growth in 2025

Read the article

Mortgage rates predicted to fall below 5% in 2025

Read the article

Commercial property market faces significant downturn in 2024

Read the article

New tenancy law balances landlord and tenant interests

Read the article

Kāinga Ora increases warnings and relocations for disruptive tenants

Read the article

Non-bank lenders see increased demand from struggling homeowners

Read the article

Call for increased bank staffing to improve mortgage processing times

Read the article

Challenger acquires Bluestone's NZ mortgage book for $597M

Read the article