Bucking a 30-year trend: Income rises set to outpace house price rises, saying goodbye to the foreign buyer ban, and has a balance been struck in the rental market?

Too long; didn't read? Here're this week's TLDRs...

Mortgage Rate Decisions Crucial Amidst Market Changes

Read the article

Limited Decline in Mortgage Rates Expected for 2025

Read the article

Borrowers Refixing in February to Gain from Rate Drops

Read the article

Key Mortgage Market Developments and Trends

Read the article

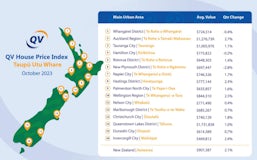

Economists Predict Modest House Price Growth in 2025

Read the article

Government Policies May Halt House Prices Outpacing Incomes

Read the article

Potential Easing of Foreign Buyer Ban on High-Value Homes

Read the article

Auckland's Residential Construction Slows Amid Fewer Consents

Read the article

Home Ownership Rate Declines to 67% in Q4 2024

Read the article

Rental Market Remains Stable Ahead of Busy Summer

Read the article

Buyer Interest on Trade Me Property

Read the article